Collider startups recently visited the London offices of one of our legal sponsors, Mathys and Squire, to discuss the world of Intellectual Property (IP). One super insightful session later, our goody bag to take home was a wealth of information, including the insights any startup should know, and how to build an IP strategy that works for you.

Said goody bag fully digested and lots of our startups prepped ready to take next steps, we thought we'd summarise our key learnings – because it would be greedy if we didn't share, right?

What is Intellectual Property?

IP – intellectual property – protects the result of your creativity as an intangible asset (or property). It does not protect an idea alone, but the ‘physical’ embodiment of that idea. There are four main types: patents, trademarks, registered designs and copyright.

Having the right type of IP protection can help prevent others copying your inventions, the names of your products or brands, the design or look of your products, and the artistic works that you write, create, produce or record.

What can I do about it?

There are some basic steps you can take to develop an IP strategy that works for you:

Understand

Get to grips with how you can use IP to both protect your business and attract interest and funding.

What are you making; what are selling; what sets you apart; are you keeping records of who has created what and when – get your head wrapped around the basics of IP, and answer these questions as a starter for ten.

Identify

You now need to identify your core IP. Find where your value lies – is it the design, the brand, the unique technology?

Strategise

Once you've identified the elements you want to protect, develop a strategy for how you'll do that – is it a trademark, copyright, design or patent?

Plan how and when you will go about putting the safety net in place and capture it all in your overarching IP strategy, even if you don't intend to register your Intellectual Property until you have secured more funding.

Execute

Take the steps you are able to take immediately, and start planning for the future. Track your sales, inventions and progress, and although it might seem a pain, record everything.

Mitigate

Keep track of what applications are being filed and approved to help de-risk your IP – various portals and tools online can assist with this and look around to see what others are doing. Patents can be a great R&D resource - to stay focussed.

Why does it matter?

IP is all about protecting, but also creating value. A solid IP strategy and goals can demonstrate a level of understanding about your present and future that will satisfy an investor’s appetite, and adds significant value as you look to scale.

"We identified four possible opportunities [Mathys and Squire] felt were worth pursuing and reviewed our existing trademark protection," said Scoop Retail, one of Collider's Class of 2015 and attendees of this workshop.

"They really took the time to understand our business!"

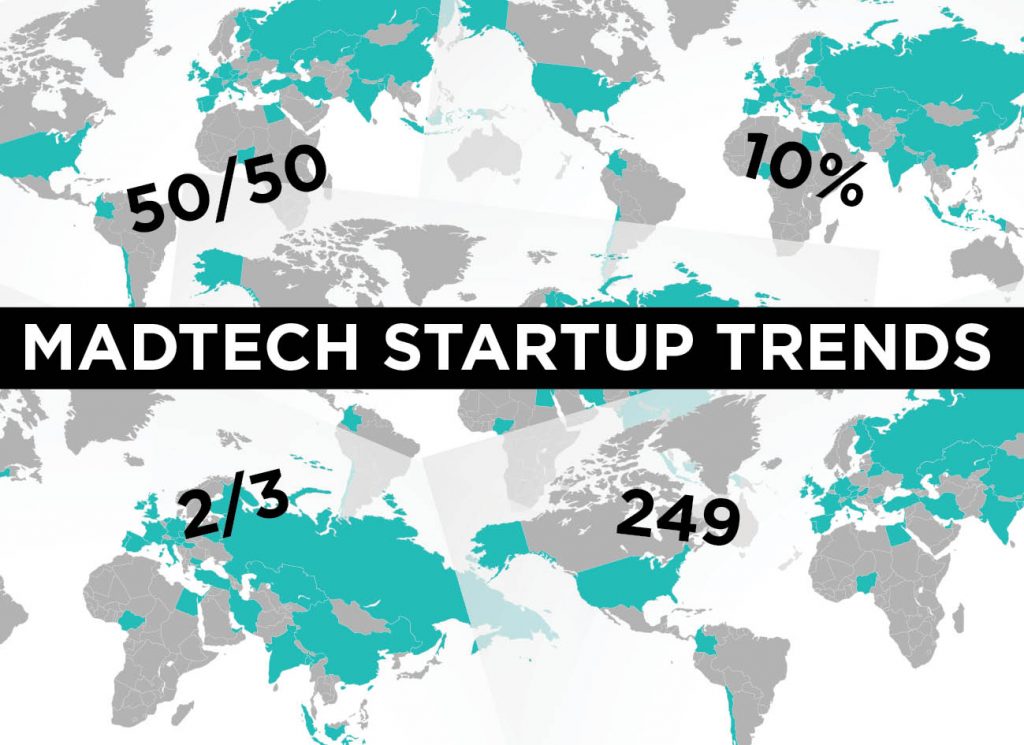

We recently heard from Frederic Court, founder of VC Felix Capital and expert in MadTech investment. Here’s his top tips on investing in this space:

We recently heard from Frederic Court, founder of VC Felix Capital and expert in MadTech investment. Here’s his top tips on investing in this space: